Who knows about Bitcoin?

-

Silver

- Level 34 Illuminated

- Posts: 5247

Re: Who knows about Bitcoin?

https://www.coindesk.com/moon-time-grow-bitcoin/

To the Moon? Time to Grow Up, Bitcoin

Michael J Casey

Nov 28, 2017 at 08:00 UTC

OPINION

Michael J. Casey is chairman of CoinDesk's advisory board and a senior advisor of blockchain research at MIT's Digital Currency Initiative.

In this opinion piece, part of a weekly series of columns, Casey suggests that bitcoin’s price might be in a bubble and that curtailing the mania around it would be good for the technology’s future.

casey, token economy

This is not "normal."

Of course, not being normal is part of bitcoin's appeal. Bitcoin has redefined money and created the hitherto non-existent concept of a scarce digital asset. It’s hard to hold it to the standards of "normal" assets.

But as someone who spent decades watching financial markets go through repeated patterns of exuberance and retrenchment, I’m quite uneasy with bitcoin’s latest runup. A 20% gain over the weekend left it up 60% over two weeks and up an eye-popping 900% year-to-date.

Record-breaking gains are irrelevant in isolation. The important question is "compared to what?" And the search for an apples-to-apples comparison is especially tricky for an asset class whose binary set of outcomes might lie in an all-or-nothing range of $0 to $1 million.

Cryptocurrencies don't have any real precedent from which to establish benchmarks. That makes them hard to value.

But being hard to value doesn’t get us off the hook. Investors must at least try to assign numbers to the assets they buy. And any rational assessment of something’s value must, by definition, compare it to the value of something else. Value is an inherently relative concept.

Tulips… there, I said it

Here's a value comparison worth thinking about.

Three long weeks ago, when bitcoin was only worth $7,000, Convoy Investments pointed out that, throughout history, the only other price performance for an asset class that exceeded bitcoin’s was the Netherlands’ infamous Tulip Mania of 1619-1622.

As most students of finance know, that one didn’t end so well.

View image on Twitter

View image on Twitter

The Long View

@HayekAndKeynes

Bitcoin compared to other bubbles. There is only one which surpasses it: the Dutch tulip mania.

The chart is from a newsletter from my long time friends at Convoy investments. If you'd like to subscribe, email them at [email protected]

8:53 AM - Nov 8, 2017

100 100 Replies 771 771 Retweets 852 852 likes

Twitter Ads info and privacy

While it’s true that resorting to the Tulip Bubble analogy has been a somewhat hackneyed, knee-jerk tool for many bitcoin critics, I think the instinct among many bitcoin bulls to mock them for resorting to it is often similarly simplistic.

William Mallers did it last week in an impassioned rebuttal of financial blogger John Lothian’s criticism of the CME Group’s plan to introduce bitcoin futures.

The problem is that such rebuttals often resort to strawman portrayals of the critic as someone who misunderstands bitcoin’s far-reaching societal potential, as an ignoramus who thinks it’s as worthless as a tulip bulb. This misses the point.

The problem with the tulip bubble wasn’t that the tulip bulbs were worth nothing, it was that a cycle of mania, speculation and FOMO (fear of missing out) pushed their price far out of line with their realizable value. It’s not unreasonable to argue that a similar phenomenon is pushing bitcoin’s price far beyond what’s justified by its unproven potential, conceivably powerful as that might be.

In one of my very first articles on bitcoin four years ago, I too evoked the Tulip Bubble comparison as the BTC price was then topping $1,200. It turned out to be prescient, as the price shortly thereafter fell to around $200 and then took three years to regain the lost ground. But by then I didn’t care. Writing that column led me to explore cryptocurrencies more deeply.

I became a convert, wrote a book about bitcoin, and ultimately left The Wall Street Journal to join the Digital Currency Initiative at MIT’s Media Lab.

The point is that I’m not alluding to tulips out of Jamie Dimon-like ignorance. I believe, strongly, in cryptocurrency technology, and just as importantly, in its core promise of a superior, more robust and universally acceptable form of money.

It’s just that I also think it’s healthy to separate that inherently hard-to-quantify aspect of its fundamental value to humanity from the particular, fleeting, quantitative expression it finds in the market.

Cult mindset

What worries me most is the cult-like mindset of the investor community, with its "to the moon" rallying cries and simplistic justifications for price performance.

The notion, for example, that bitcoin’s in-built scarcity will drive its price higher ad infinitum assumes it operates in some kind of detached vacuum. The ever-present prospect of software forks, while not technically adding to the supply of bitcoin core, points to a wide set of options for investors in the future.

If they find those options more appealing – and who’s to say a better idea won’t come along? – it will matter nothing that only 21 million coins will ever be produced. (For a brutal breakdown of other pro-BTC arguments, read this critique by the economist Constantin Gurgdiev, who, like me, is a believer in the underlying power of cryptocurrency technology.)

The problem I have with the immaturity of bitcoin’s investing culture is not that it’s setting the market up for a correction. It’s that it constrains progress toward attaining the technology’s more fundamental social value.

Speculation is unavoidable, even useful in bootstrapping innovation. But if bitcoin is to change billions of lives, it needs to become a more mainstream asset class, one that’s connected to the real world that those people occupy. As much as we might all love this quirky, abnormal "honeybadger of money," bitcoin needs to become more normal.

It needs more stability. It needs a two-way market.

That two-way market is coming. And it will be brought to us by financial professionals, hordes of whom will be showing up at CoinDesk’s inaugural Consensus: Invest conference Tuesday. At the same time that venture capitalists and hedge funds are creating investment vehicles to take positive bets on bitcoin and other crypto assets, investment banks and exchanges are creating facilities that will allow other institutions to bet against it.

Futures in bitcoin’s future

The bitcoin bulls who’ve welcomed the CME Group’s plans to introduce bitcoin futures contracts before year-end as an easier way for institutional investors to invest in the sector might want to be more careful what they wish for.

The quarterly-ROI-obsessed fund managers who will trade these contracts share none of quasi-religious mindset of bitcoin HODLers. And now they have a tool, in the futures contracts themselves, with which to short the market.

If it makes sense to do so, they will gladly take actions that drive the price lower. Wall Street is pragmatic, self-interested and obsessed with its short-term bottom line. It doesn’t HODL.

To be sure, it’s not clear how much of an immediate impact futures trading will have on the spot market for bitcoin – the CME’s contracts will be cash-settled, which means that neither counterparty to a trade takes physical ownership of the underlying asset. Investors will merely treat the underlying bitcoin market as a reference.

But as the futures market gains liquidity, and as cross-market hedging strategies become more sophisticated, the futures price on the CME may well become a driver of spot market prices. With such an imbalance between the sizes of the institutional and retail markets, the tail could start wagging the dog.

Here’s the thing: This rite of passage is welcome. By lowering volatility, two-way institutional engagement will increase the impact that bitcoin can have on the world.

It’s an important step in fulfilling bitcoin's purpose. But it also means the moon might have to wait.

To the Moon? Time to Grow Up, Bitcoin

Michael J Casey

Nov 28, 2017 at 08:00 UTC

OPINION

Michael J. Casey is chairman of CoinDesk's advisory board and a senior advisor of blockchain research at MIT's Digital Currency Initiative.

In this opinion piece, part of a weekly series of columns, Casey suggests that bitcoin’s price might be in a bubble and that curtailing the mania around it would be good for the technology’s future.

casey, token economy

This is not "normal."

Of course, not being normal is part of bitcoin's appeal. Bitcoin has redefined money and created the hitherto non-existent concept of a scarce digital asset. It’s hard to hold it to the standards of "normal" assets.

But as someone who spent decades watching financial markets go through repeated patterns of exuberance and retrenchment, I’m quite uneasy with bitcoin’s latest runup. A 20% gain over the weekend left it up 60% over two weeks and up an eye-popping 900% year-to-date.

Record-breaking gains are irrelevant in isolation. The important question is "compared to what?" And the search for an apples-to-apples comparison is especially tricky for an asset class whose binary set of outcomes might lie in an all-or-nothing range of $0 to $1 million.

Cryptocurrencies don't have any real precedent from which to establish benchmarks. That makes them hard to value.

But being hard to value doesn’t get us off the hook. Investors must at least try to assign numbers to the assets they buy. And any rational assessment of something’s value must, by definition, compare it to the value of something else. Value is an inherently relative concept.

Tulips… there, I said it

Here's a value comparison worth thinking about.

Three long weeks ago, when bitcoin was only worth $7,000, Convoy Investments pointed out that, throughout history, the only other price performance for an asset class that exceeded bitcoin’s was the Netherlands’ infamous Tulip Mania of 1619-1622.

As most students of finance know, that one didn’t end so well.

View image on Twitter

View image on Twitter

The Long View

@HayekAndKeynes

Bitcoin compared to other bubbles. There is only one which surpasses it: the Dutch tulip mania.

The chart is from a newsletter from my long time friends at Convoy investments. If you'd like to subscribe, email them at [email protected]

8:53 AM - Nov 8, 2017

100 100 Replies 771 771 Retweets 852 852 likes

Twitter Ads info and privacy

While it’s true that resorting to the Tulip Bubble analogy has been a somewhat hackneyed, knee-jerk tool for many bitcoin critics, I think the instinct among many bitcoin bulls to mock them for resorting to it is often similarly simplistic.

William Mallers did it last week in an impassioned rebuttal of financial blogger John Lothian’s criticism of the CME Group’s plan to introduce bitcoin futures.

The problem is that such rebuttals often resort to strawman portrayals of the critic as someone who misunderstands bitcoin’s far-reaching societal potential, as an ignoramus who thinks it’s as worthless as a tulip bulb. This misses the point.

The problem with the tulip bubble wasn’t that the tulip bulbs were worth nothing, it was that a cycle of mania, speculation and FOMO (fear of missing out) pushed their price far out of line with their realizable value. It’s not unreasonable to argue that a similar phenomenon is pushing bitcoin’s price far beyond what’s justified by its unproven potential, conceivably powerful as that might be.

In one of my very first articles on bitcoin four years ago, I too evoked the Tulip Bubble comparison as the BTC price was then topping $1,200. It turned out to be prescient, as the price shortly thereafter fell to around $200 and then took three years to regain the lost ground. But by then I didn’t care. Writing that column led me to explore cryptocurrencies more deeply.

I became a convert, wrote a book about bitcoin, and ultimately left The Wall Street Journal to join the Digital Currency Initiative at MIT’s Media Lab.

The point is that I’m not alluding to tulips out of Jamie Dimon-like ignorance. I believe, strongly, in cryptocurrency technology, and just as importantly, in its core promise of a superior, more robust and universally acceptable form of money.

It’s just that I also think it’s healthy to separate that inherently hard-to-quantify aspect of its fundamental value to humanity from the particular, fleeting, quantitative expression it finds in the market.

Cult mindset

What worries me most is the cult-like mindset of the investor community, with its "to the moon" rallying cries and simplistic justifications for price performance.

The notion, for example, that bitcoin’s in-built scarcity will drive its price higher ad infinitum assumes it operates in some kind of detached vacuum. The ever-present prospect of software forks, while not technically adding to the supply of bitcoin core, points to a wide set of options for investors in the future.

If they find those options more appealing – and who’s to say a better idea won’t come along? – it will matter nothing that only 21 million coins will ever be produced. (For a brutal breakdown of other pro-BTC arguments, read this critique by the economist Constantin Gurgdiev, who, like me, is a believer in the underlying power of cryptocurrency technology.)

The problem I have with the immaturity of bitcoin’s investing culture is not that it’s setting the market up for a correction. It’s that it constrains progress toward attaining the technology’s more fundamental social value.

Speculation is unavoidable, even useful in bootstrapping innovation. But if bitcoin is to change billions of lives, it needs to become a more mainstream asset class, one that’s connected to the real world that those people occupy. As much as we might all love this quirky, abnormal "honeybadger of money," bitcoin needs to become more normal.

It needs more stability. It needs a two-way market.

That two-way market is coming. And it will be brought to us by financial professionals, hordes of whom will be showing up at CoinDesk’s inaugural Consensus: Invest conference Tuesday. At the same time that venture capitalists and hedge funds are creating investment vehicles to take positive bets on bitcoin and other crypto assets, investment banks and exchanges are creating facilities that will allow other institutions to bet against it.

Futures in bitcoin’s future

The bitcoin bulls who’ve welcomed the CME Group’s plans to introduce bitcoin futures contracts before year-end as an easier way for institutional investors to invest in the sector might want to be more careful what they wish for.

The quarterly-ROI-obsessed fund managers who will trade these contracts share none of quasi-religious mindset of bitcoin HODLers. And now they have a tool, in the futures contracts themselves, with which to short the market.

If it makes sense to do so, they will gladly take actions that drive the price lower. Wall Street is pragmatic, self-interested and obsessed with its short-term bottom line. It doesn’t HODL.

To be sure, it’s not clear how much of an immediate impact futures trading will have on the spot market for bitcoin – the CME’s contracts will be cash-settled, which means that neither counterparty to a trade takes physical ownership of the underlying asset. Investors will merely treat the underlying bitcoin market as a reference.

But as the futures market gains liquidity, and as cross-market hedging strategies become more sophisticated, the futures price on the CME may well become a driver of spot market prices. With such an imbalance between the sizes of the institutional and retail markets, the tail could start wagging the dog.

Here’s the thing: This rite of passage is welcome. By lowering volatility, two-way institutional engagement will increase the impact that bitcoin can have on the world.

It’s an important step in fulfilling bitcoin's purpose. But it also means the moon might have to wait.

-

Silver

- Level 34 Illuminated

- Posts: 5247

Re: Who knows about Bitcoin?

http://www.zerohedge.com/news/2017-11-2 ... in-backers

Japanese billionaire Masatoshi Kumagai, co-founder of giant GMO Internet, announced plans recently to invest over $90 million in a new Bitcoin mining business that will operate as a fund, partially by soliciting capital from investors and repaying them in cryptocurrency.

In North America, billionaire backing is going into HIVE (TSVX:HIVE.V), via Lionsgate Entertainment and Goldcorp (NYSE:GG) superstar Frank Giustra, a legendary mining figure known for being in the right place at the right time—and always in front of a trend.

The new Great Game is virtual reality, and while governments are busy trying to figure out how they can control it, investors are busy sinking billions into what is fast becoming a story of industrial-scale cryptocurrency mining.

Now that everyone’s seen how resilient Bitcoin is, not only are things moving to the industrial phase, but everyone’s weighing the best venues for mining. Because even though this is virtual reality, location still matters.

That’s why HIVE has set up in Iceland, where Mother Nature’s natural cooling is friendly to these massive computing facilities, and where the massive energy required to mine cryptocurrency—in this case Ether--on an industrial scale is cheaper thanks to plentiful hydroelectric and geothermal sources. First, HIVE put $9 million into Hong Kong-based Genesis Mining Ltd., which just built the biggest ether-mining facility in the world—Enigma. Genesis acquired 30% of HIVE in the deal. A second deal in mid-October saw HIVE close a $30-million bought deal financing, completing a $7-million investment by Genesis Mining, acquiring a second data center in Iceland.

And now HIVE is setting up in another ‘cold country’—Sweden—with Genesis.

From China and Russia to North America, virtual is the reality. It’s no longer a question of whether cryptocurrency will survive. It’s a question of what it will disrupt on its way to the top of the global finance chain.

Japanese billionaire Masatoshi Kumagai, co-founder of giant GMO Internet, announced plans recently to invest over $90 million in a new Bitcoin mining business that will operate as a fund, partially by soliciting capital from investors and repaying them in cryptocurrency.

In North America, billionaire backing is going into HIVE (TSVX:HIVE.V), via Lionsgate Entertainment and Goldcorp (NYSE:GG) superstar Frank Giustra, a legendary mining figure known for being in the right place at the right time—and always in front of a trend.

The new Great Game is virtual reality, and while governments are busy trying to figure out how they can control it, investors are busy sinking billions into what is fast becoming a story of industrial-scale cryptocurrency mining.

Now that everyone’s seen how resilient Bitcoin is, not only are things moving to the industrial phase, but everyone’s weighing the best venues for mining. Because even though this is virtual reality, location still matters.

That’s why HIVE has set up in Iceland, where Mother Nature’s natural cooling is friendly to these massive computing facilities, and where the massive energy required to mine cryptocurrency—in this case Ether--on an industrial scale is cheaper thanks to plentiful hydroelectric and geothermal sources. First, HIVE put $9 million into Hong Kong-based Genesis Mining Ltd., which just built the biggest ether-mining facility in the world—Enigma. Genesis acquired 30% of HIVE in the deal. A second deal in mid-October saw HIVE close a $30-million bought deal financing, completing a $7-million investment by Genesis Mining, acquiring a second data center in Iceland.

And now HIVE is setting up in another ‘cold country’—Sweden—with Genesis.

From China and Russia to North America, virtual is the reality. It’s no longer a question of whether cryptocurrency will survive. It’s a question of what it will disrupt on its way to the top of the global finance chain.

-

Silver

- Level 34 Illuminated

- Posts: 5247

Re: Who knows about Bitcoin?

Bitcoin is selling for about $11,000 (US) in London right now, or about 8,810 Euros.

https://cex.io/btc-usd

Of course, it will be different when you click on the link above.

Just for the sake of clarity, are you aware that you can purchase less than one Bitcoin? You can purchase a partial Bitcoin with just 50 bucks or even less. Please don't use your grocery money to something like Bitcoin.

https://cex.io/btc-usd

Of course, it will be different when you click on the link above.

Just for the sake of clarity, are you aware that you can purchase less than one Bitcoin? You can purchase a partial Bitcoin with just 50 bucks or even less. Please don't use your grocery money to something like Bitcoin.

- BeNotDeceived

- Agent38

- Posts: 9058

- Location: Tralfamadore

- Contact:

Re: Who knows about Bitcoin?

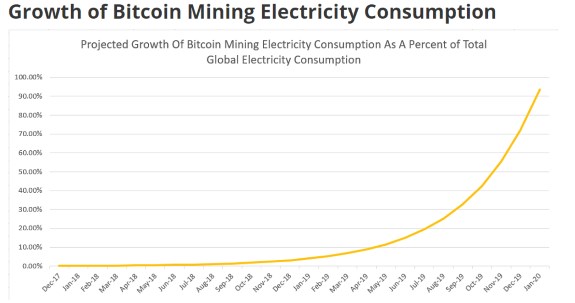

Fortunately headway is being made:http://www.businessworld.in/article/Bitcoin-Electricity-Consumption-Unsustainable-Cryptocurrency/29-11-2017-133168/ wrote: Bitcoin Electricity Consumption: Unsustainable Cryptocurrency

... A lot of bitcoin mining is done in China, which still uses large amounts of non-renewable, CO2 emitting fossil fuels for energy, making the mining process an inherently unsustainable, ecologically deteriorating process. ...

In fact, some of the bewildering facts according to PowerCompare.co.uk are as follows-

In the past month alone, Bitcoin mining electricity consumption is estimated to have increased by 29.98%

If it keeps increasing at this rate, Bitcoin mining will consume all the world’s electricity by February 2020.

Number of Americans who could be powered by bitcoin mining: 2.4 million ... WASTED

Google Alert: Titanium Hydrogen Storage towards a PERFECT CURRENCY!

How bad will it get in the mean time

29.98, somebody needs to practice proper use of significant digits, it would seem.

-

Silver

- Level 34 Illuminated

- Posts: 5247

Re: Who knows about Bitcoin?

74% of all statistics are just made up.BeNotDeceived wrote: ↑November 29th, 2017, 4:40 am In the past month alone, Bitcoin mining electricity consumption is estimated to have increased by 29.98%

-

Silver

- Level 34 Illuminated

- Posts: 5247

Re: Who knows about Bitcoin?

https://cex.io/btc-usd

BTC/USD

11521.5810

Click on the link below to see all the graphs referred to in the article there.

https://medium.com/@mcasey0827/speculat ... ed48ecf7da

Speculative Bitcoin Adoption/Price Theory

Provisos

This is only a speculative theory and may be incorrect in part or in whole. Cryptocurrencies are inherently volatile in nature at this stage and no future performance is certain. DO NOT INVEST ANYTHING MORE INTO CRYPTOCURRENCIES THAN YOU ARE PREPARED TO LOSE IN TOTALITY.

This paper refers specifically to “Bitcoin” simply because it is the most historical, liquid and widely used cryptocurrency currently in existence. The ideas stated here do not apply exclusively to Bitcoin, but rather to cryptocurrency as a whole. Another cryptocurrency may one day supplant Bitcoin, in which case I would expect it to act in the same manner I am describing of Bitcoin. This may be potentially mitigated by studied diversification, but that is out of the scope of this writing.

This paper assumes that eventual near-universal adoption of Bitcoin or 2nd tier technologies (ex. Lightning Network, Sidechains, etc.) based on Bitcoin is a foregone conclusion. While this notion is certainly debatable, the debate remains out of the scope of this writing.

Theory

Simply put:

The growth of adoption of Bitcoin and therefore bitcoin price is following an S-Curve of Technological Adoption, which is itself characterized by fractally repeating, exponentially increasing Gartner Hype Cycles.

This theory represents an overarching long-term fundamental factor that dwarfs the effects of other fundamentals such as: exchange hackings, government regulatory announcements, changes in economic policy and further technological advancement of the protocol. Although, it is important to note that these other fundamentals may spur transitions between Gartner Hype Cycle stages.

The S-Curve of Technological Adoption

As stated above, this paper assumes eventual near universal adoption of Bitcoin. So how does anything transition from a state of zero adoption to complete adoption?

One of the most familiar concepts in marketing is the bell curve of adoption:

The parabolic curve represents and exponential increase in adoption up until median saturation, then a logarithmic decline in adoption until the whole potential population has adopted. Assuming near-universal adoption, Bitcoin is still likely in the “Innovator” phase, or just barely into the “Early Adopter” phase.

If you make the bell curve cumulative to represent the total adoptive population at a given time, you get the S-curve of Adoption as characterized by the yellow line below:

It’s called the S-curve simply because of its letter “S” shape. Its defining characteristic is the extremely slow exponential ramp up to the point at which growth “goes vertical”, and super-majority adoption is rapidly achieved. Throughout the 20th century every major mass-market technology that was near-universally adopted has exhibited some form of an S-curve, as indicated in the chart below:

In addition, S-curves are becoming more compressed as technology advances, leading to more pronounced vertical growth adoption phases.

So, if Bitcoin is following a standard S-curve, then why is so volatile? Over the long term (decades or more), technological adoption S-curves appear to be very smooth. However, in the short-term, rates of adoption (typically sales to new customers) are highly volatile. If Bitcoin is following a standard S-Curve, the massive exponential increase of the final majority mass adoption will make all present volatility look extraordinarily flat by comparison. This is why long term bitcoin price charts are best viewed on a logarithmic scale.

S-curves can be volatile, but must sustain exponential growth in the long term.

Bitcoin Bubbles & Gartner Hype Cycles

If one researches Bitcoin for any length of time, one invariably encounters the phenomenon of the bitcoin bubble. The price, after rising slowly but fairly steadily for a length time, suddenly explodes by 5–10% a day for a sustained period of time culminating in typically a full order of magnitude (~1,000%) increase over its previous value. This is known in Bitcoin circles as a “Bull Run”.

Since these bubbles are inherently speculative in nature, they reach a point known as “The Height of Irrational Exuberance”, where the sellers begin to outnumber the buys and the bubble pops and the price crashes down to a range above the pre-bubble price; but many multiples lower than the peak. This is typically the time Bitcoin begins to be pronounced dead by many economists and news outlets.

The price stabilizes around this low value for some time, which I refer to as “The Boring Low”. If you are looking to accumulate, this is typically the best time. In this stage no amount of good news seems to affect the price in any manner.

Eventually, the market begins to view the price as stable and speculative investment resumes. This leads to the next stage (which we are currently in), that I call “The Volatilic Rise”. In this stage, the price stair-steps its way back into the vicinity of the old high. Once the price reaches a sustained level of 80–90% the old peak, the bubble cycle typically starts over again with another bull run.

The Nov. 2013 bubble to Present:

When looking at the structure of the bubble phenomenon, it is difficult not to be reminded of another commonly accepted concept in technology: the Gartner Hype Cycle, which illustrates Amara’s Law:

“We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run.”

Gartner Hype Cycle:

Basically, for anything new there is a mad flurry of excitement over potential applications, followed by the realization that most of them don’t work, followed by a slow learning of what does work, followed by sustained progress.

After much careful examination; it becomes apparent that a roughly analogous pattern of excitement, disappointment, and cautious optimism occurs in both a Gartner Hype Cycle and bitcoin bubble.

Unlike a typical Gartner Hype Cycle, a bitcoin bubble does not reach a steady state of gradual increase. As mentioned before, it must continue to follow the exponentially increasing path of the S-curve. Why then does it follow the hype cycle at all? This is because the nature of bitcoin investment is almost entirely speculative. Speculation is driven, in large measure, by hype.

To illustrate the relationship of hype over bitcoin to bitcoin price, this chart shows the base-10 logarithmic bitcoin price plotted along with Google Searched for “bitcoin” as found on Google Trends:

It has been noted that in the past, extreme spikes in google searches for “bitcoin” and “buy bitcoin” have been leading indicators of bitcoin price increases be several weeks; presumably because of the historical learning curve required to purchase and manage bitcoin.

Because the price of bitcoin rises so phenomenally fast during a bull run, speculators begin to view the price as illegitimate and unsustainable. A great many who bought in before or early on in the bull run, liquidate to lock in profits, leading to the crash. Only after the stable Boring Low and the steady Volatilic Rise, do the speculators consider the possibility of the bull run price being “legitimate”. Once legitimate and established as the new base line, the hype cycle begins anew with another bull run.

Exponential Fractals

Fractals are a fascinating branch of mathematics, in which often relatively simple formulas evaluate to infinite complex patterns that repeat themselves over and over again at different orders of magnitude. Fractal mathematics are often employed in technical analysis of Forex markets and by high frequency trading bots.

Though I have not seen any work toward a definitive fractal formula that describes the way bitcoin’s price behaves, I believe there is ample evidence that a fractal pattern is present. It represents itself in the form of exponential bitcoin bubbles driven by Gartner Hype Cycles. I’d imagine there is enough to study in this area for several Doctorate dissertations.

The next few pages illustrate the striking similarity of the fractal pattern of the bitcoin bubbles, each roughly a full order of magnitude greater than the preceding.

Nov 2013 bubble with preceding Feb 2013 bubble:

Feb 2013 bubble with preceding Jun 2011 bubble:

Jun 2011 bubble with preceding Jan 2011 bubble:

Jan 2011 bubble with preceding Nov 2010 bubble:

I believe that the pattern is a fairly pure representation of the psychology of large groups of independent speculators each attempting to act rationally trading a rapidly appreciating asset. The primary motivators of these movements are greed and fear and are fundamental to human nature. The bull run happens due to a tipping point of hype where greed and fear of missing out (FOMO) take hold and speculative fervor ensues. More speculators see this and jump on the bandwagon, accelerating the run. Eventually, the return for the initial speculators grows so large, their fear of losing the money they have earned outweighs their greed for more and they begin to sell. The price increase has been far too rapid to possibly be legitimate.

From here, the bull run peaks out and the crash begins. People who bought in at the height of the fervor begin to lose money and sell to avoid further losses. These people are typically short term speculators generally uninterested in the technology and looking only to make a quick profit in fiat. They are commonly referred to as “weak hands”, because they fold (sell) at the first sign of trouble; usually losing money on the transaction. The crash is the process of the market shaking out all of the weak hands. The crash ends when nobody with bitcoin is willing to sell it, these are typically long term holders and the total number (and combined worth) of them grows after each bull run.

After the crash, the narratives of Bitcoin dying or being too volatile to serve as a store of value need time to subside. During the boring low, there is not much speculative action and the price remains relatively stable. New speculators see no reason to jump into the market as the asset isn’t appreciating and those holding don’t want to sell at a low. This continues on until speculators begin to view the price as stable.

As time goes by with a stable price, speculators collectively begin to see the value as potentially low. Several new whales research the technology and buy relatively large amount spurring mini-bubbles that spike and then reverberate stabilizing over time with a general uptrend. This stage I refer to as “the Volatilic Rise”. The price basically stair-steps in increments on the order of magnitude of the pre bull run high (ex. right now they are ~$100). The price rises and falls, generally with a long term upward trend until reaching roughly 80% of the peak price of the bull run. The formerly impossible price of the peak now appears real and relatively stable. A new hype cycle begins and greed and FOMO lead toward a new bull run.

That’s the cycle. By my count is has happened in Bitcoin 5 times so far, and as human nature does not fundamentally change I see no reason why it won’t happen 2–3 more times:

The last bull run that happens will be the exponential increase that characterizes the S-curve; wherein the majority of the population of the planet will all adopt bitcoin in a relatively short period of time. This is known as the knee of the S-curve where it goes vertical and is likely still years away. When bitcoin takes over, it will happen quickly.

Conclusion

Bitcoin is probably the purest example of speculative adoption humanity has seen to date. It is following a typical technological adoption curve at a rapid pace. The S-curve is made up hype cycles which repeat in a fractal manner. Each fractal repetition is roughly one order of magnitude greater than the one prior. Since reaching dollar parity, the percentage increase of each bubble over the last has been decreasing, even though the $ increase grows exponentially. There are likely 2–3 remaining hype cycles before Bitcoin becomes near-universally adopted.

At present, all technical indications are that we are several months away from a new hype cycle and bull run. I anticipate we have one more plateau in the volatilic rise phase before then, likely around $900.

It is impossible to tell the exact timing and exact peak of a bull run, however general time frame and rough order of magnitude seem plausibly predictable. I first identified this pattern in mid-2013 when the price was $70, with a former all time high of $258. I was able use this knowledge to forecast the rough timing and order of magnitude of the November 2013 bull run to $1,177. My models however had me convinced the peak of that bull run would be ~$2,500. I have since come to the conclusion that accurately calling the top of such a massive increase is a fool’s errand. As a general practice, you are better off selling progressively toward the top, then waiting for the crash and buying back progressively toward the boring low; with the goal of increasing your long-term bitcoin holdings.

Again, all of this is pure speculation. Please take this information with a grain of salt and do not risk anything you would be uncomfortable losing.

Michael B. Casey

BTC/USD

11521.5810

Click on the link below to see all the graphs referred to in the article there.

https://medium.com/@mcasey0827/speculat ... ed48ecf7da

Speculative Bitcoin Adoption/Price Theory

Provisos

This is only a speculative theory and may be incorrect in part or in whole. Cryptocurrencies are inherently volatile in nature at this stage and no future performance is certain. DO NOT INVEST ANYTHING MORE INTO CRYPTOCURRENCIES THAN YOU ARE PREPARED TO LOSE IN TOTALITY.

This paper refers specifically to “Bitcoin” simply because it is the most historical, liquid and widely used cryptocurrency currently in existence. The ideas stated here do not apply exclusively to Bitcoin, but rather to cryptocurrency as a whole. Another cryptocurrency may one day supplant Bitcoin, in which case I would expect it to act in the same manner I am describing of Bitcoin. This may be potentially mitigated by studied diversification, but that is out of the scope of this writing.

This paper assumes that eventual near-universal adoption of Bitcoin or 2nd tier technologies (ex. Lightning Network, Sidechains, etc.) based on Bitcoin is a foregone conclusion. While this notion is certainly debatable, the debate remains out of the scope of this writing.

Theory

Simply put:

The growth of adoption of Bitcoin and therefore bitcoin price is following an S-Curve of Technological Adoption, which is itself characterized by fractally repeating, exponentially increasing Gartner Hype Cycles.

This theory represents an overarching long-term fundamental factor that dwarfs the effects of other fundamentals such as: exchange hackings, government regulatory announcements, changes in economic policy and further technological advancement of the protocol. Although, it is important to note that these other fundamentals may spur transitions between Gartner Hype Cycle stages.

The S-Curve of Technological Adoption

As stated above, this paper assumes eventual near universal adoption of Bitcoin. So how does anything transition from a state of zero adoption to complete adoption?

One of the most familiar concepts in marketing is the bell curve of adoption:

The parabolic curve represents and exponential increase in adoption up until median saturation, then a logarithmic decline in adoption until the whole potential population has adopted. Assuming near-universal adoption, Bitcoin is still likely in the “Innovator” phase, or just barely into the “Early Adopter” phase.

If you make the bell curve cumulative to represent the total adoptive population at a given time, you get the S-curve of Adoption as characterized by the yellow line below:

It’s called the S-curve simply because of its letter “S” shape. Its defining characteristic is the extremely slow exponential ramp up to the point at which growth “goes vertical”, and super-majority adoption is rapidly achieved. Throughout the 20th century every major mass-market technology that was near-universally adopted has exhibited some form of an S-curve, as indicated in the chart below:

In addition, S-curves are becoming more compressed as technology advances, leading to more pronounced vertical growth adoption phases.

So, if Bitcoin is following a standard S-curve, then why is so volatile? Over the long term (decades or more), technological adoption S-curves appear to be very smooth. However, in the short-term, rates of adoption (typically sales to new customers) are highly volatile. If Bitcoin is following a standard S-Curve, the massive exponential increase of the final majority mass adoption will make all present volatility look extraordinarily flat by comparison. This is why long term bitcoin price charts are best viewed on a logarithmic scale.

S-curves can be volatile, but must sustain exponential growth in the long term.

Bitcoin Bubbles & Gartner Hype Cycles

If one researches Bitcoin for any length of time, one invariably encounters the phenomenon of the bitcoin bubble. The price, after rising slowly but fairly steadily for a length time, suddenly explodes by 5–10% a day for a sustained period of time culminating in typically a full order of magnitude (~1,000%) increase over its previous value. This is known in Bitcoin circles as a “Bull Run”.

Since these bubbles are inherently speculative in nature, they reach a point known as “The Height of Irrational Exuberance”, where the sellers begin to outnumber the buys and the bubble pops and the price crashes down to a range above the pre-bubble price; but many multiples lower than the peak. This is typically the time Bitcoin begins to be pronounced dead by many economists and news outlets.

The price stabilizes around this low value for some time, which I refer to as “The Boring Low”. If you are looking to accumulate, this is typically the best time. In this stage no amount of good news seems to affect the price in any manner.

Eventually, the market begins to view the price as stable and speculative investment resumes. This leads to the next stage (which we are currently in), that I call “The Volatilic Rise”. In this stage, the price stair-steps its way back into the vicinity of the old high. Once the price reaches a sustained level of 80–90% the old peak, the bubble cycle typically starts over again with another bull run.

The Nov. 2013 bubble to Present:

When looking at the structure of the bubble phenomenon, it is difficult not to be reminded of another commonly accepted concept in technology: the Gartner Hype Cycle, which illustrates Amara’s Law:

“We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run.”

Gartner Hype Cycle:

Basically, for anything new there is a mad flurry of excitement over potential applications, followed by the realization that most of them don’t work, followed by a slow learning of what does work, followed by sustained progress.

After much careful examination; it becomes apparent that a roughly analogous pattern of excitement, disappointment, and cautious optimism occurs in both a Gartner Hype Cycle and bitcoin bubble.

Unlike a typical Gartner Hype Cycle, a bitcoin bubble does not reach a steady state of gradual increase. As mentioned before, it must continue to follow the exponentially increasing path of the S-curve. Why then does it follow the hype cycle at all? This is because the nature of bitcoin investment is almost entirely speculative. Speculation is driven, in large measure, by hype.

To illustrate the relationship of hype over bitcoin to bitcoin price, this chart shows the base-10 logarithmic bitcoin price plotted along with Google Searched for “bitcoin” as found on Google Trends:

It has been noted that in the past, extreme spikes in google searches for “bitcoin” and “buy bitcoin” have been leading indicators of bitcoin price increases be several weeks; presumably because of the historical learning curve required to purchase and manage bitcoin.

Because the price of bitcoin rises so phenomenally fast during a bull run, speculators begin to view the price as illegitimate and unsustainable. A great many who bought in before or early on in the bull run, liquidate to lock in profits, leading to the crash. Only after the stable Boring Low and the steady Volatilic Rise, do the speculators consider the possibility of the bull run price being “legitimate”. Once legitimate and established as the new base line, the hype cycle begins anew with another bull run.

Exponential Fractals

Fractals are a fascinating branch of mathematics, in which often relatively simple formulas evaluate to infinite complex patterns that repeat themselves over and over again at different orders of magnitude. Fractal mathematics are often employed in technical analysis of Forex markets and by high frequency trading bots.

Though I have not seen any work toward a definitive fractal formula that describes the way bitcoin’s price behaves, I believe there is ample evidence that a fractal pattern is present. It represents itself in the form of exponential bitcoin bubbles driven by Gartner Hype Cycles. I’d imagine there is enough to study in this area for several Doctorate dissertations.

The next few pages illustrate the striking similarity of the fractal pattern of the bitcoin bubbles, each roughly a full order of magnitude greater than the preceding.

Nov 2013 bubble with preceding Feb 2013 bubble:

Feb 2013 bubble with preceding Jun 2011 bubble:

Jun 2011 bubble with preceding Jan 2011 bubble:

Jan 2011 bubble with preceding Nov 2010 bubble:

I believe that the pattern is a fairly pure representation of the psychology of large groups of independent speculators each attempting to act rationally trading a rapidly appreciating asset. The primary motivators of these movements are greed and fear and are fundamental to human nature. The bull run happens due to a tipping point of hype where greed and fear of missing out (FOMO) take hold and speculative fervor ensues. More speculators see this and jump on the bandwagon, accelerating the run. Eventually, the return for the initial speculators grows so large, their fear of losing the money they have earned outweighs their greed for more and they begin to sell. The price increase has been far too rapid to possibly be legitimate.

From here, the bull run peaks out and the crash begins. People who bought in at the height of the fervor begin to lose money and sell to avoid further losses. These people are typically short term speculators generally uninterested in the technology and looking only to make a quick profit in fiat. They are commonly referred to as “weak hands”, because they fold (sell) at the first sign of trouble; usually losing money on the transaction. The crash is the process of the market shaking out all of the weak hands. The crash ends when nobody with bitcoin is willing to sell it, these are typically long term holders and the total number (and combined worth) of them grows after each bull run.

After the crash, the narratives of Bitcoin dying or being too volatile to serve as a store of value need time to subside. During the boring low, there is not much speculative action and the price remains relatively stable. New speculators see no reason to jump into the market as the asset isn’t appreciating and those holding don’t want to sell at a low. This continues on until speculators begin to view the price as stable.

As time goes by with a stable price, speculators collectively begin to see the value as potentially low. Several new whales research the technology and buy relatively large amount spurring mini-bubbles that spike and then reverberate stabilizing over time with a general uptrend. This stage I refer to as “the Volatilic Rise”. The price basically stair-steps in increments on the order of magnitude of the pre bull run high (ex. right now they are ~$100). The price rises and falls, generally with a long term upward trend until reaching roughly 80% of the peak price of the bull run. The formerly impossible price of the peak now appears real and relatively stable. A new hype cycle begins and greed and FOMO lead toward a new bull run.

That’s the cycle. By my count is has happened in Bitcoin 5 times so far, and as human nature does not fundamentally change I see no reason why it won’t happen 2–3 more times:

The last bull run that happens will be the exponential increase that characterizes the S-curve; wherein the majority of the population of the planet will all adopt bitcoin in a relatively short period of time. This is known as the knee of the S-curve where it goes vertical and is likely still years away. When bitcoin takes over, it will happen quickly.

Conclusion

Bitcoin is probably the purest example of speculative adoption humanity has seen to date. It is following a typical technological adoption curve at a rapid pace. The S-curve is made up hype cycles which repeat in a fractal manner. Each fractal repetition is roughly one order of magnitude greater than the one prior. Since reaching dollar parity, the percentage increase of each bubble over the last has been decreasing, even though the $ increase grows exponentially. There are likely 2–3 remaining hype cycles before Bitcoin becomes near-universally adopted.

At present, all technical indications are that we are several months away from a new hype cycle and bull run. I anticipate we have one more plateau in the volatilic rise phase before then, likely around $900.

It is impossible to tell the exact timing and exact peak of a bull run, however general time frame and rough order of magnitude seem plausibly predictable. I first identified this pattern in mid-2013 when the price was $70, with a former all time high of $258. I was able use this knowledge to forecast the rough timing and order of magnitude of the November 2013 bull run to $1,177. My models however had me convinced the peak of that bull run would be ~$2,500. I have since come to the conclusion that accurately calling the top of such a massive increase is a fool’s errand. As a general practice, you are better off selling progressively toward the top, then waiting for the crash and buying back progressively toward the boring low; with the goal of increasing your long-term bitcoin holdings.

Again, all of this is pure speculation. Please take this information with a grain of salt and do not risk anything you would be uncomfortable losing.

Michael B. Casey

- BeNotDeceived

- Agent38

- Posts: 9058

- Location: Tralfamadore

- Contact:

Re: Who knows about Bitcoin?

Sounds high, and the site links to powercompare that looks very legit. Here’s another source, the thing looks more like a space heater than a computer. Great if you live in a cold place and use electricity for heat.Silver wrote: ↑November 29th, 2017, 5:23 am74% of all statistics are just made up.BeNotDeceived wrote: ↑November 29th, 2017, 4:40 am In the past month alone, Bitcoin mining electricity consumption is estimated to have increased by 29.98%

Proof-of-stake sounds similar to what I suggest, where the stake is real energy.https://interestingengineering.com/a-single-bitcoin-transaction-now-consumes-as-much-electricity-as-your-house-does-in-a-week wrote:

...

Is it possible for Bitcoin to reverse the damage?

"Blockchain is inefficient tech by design, as we create trust by building a system based on distrust. If you only trust yourself and a set of rules (the software), then you have to validate everything that happens against these rules yourself. That is the life of a blockchain node," he said via direct message, Digiconomist told Motherboard.

However, he believes there are alternatives, namely Proof-of-stake is a consensus algorithm which allows coin owners, as opposed to miners, create blocks. This removes the need for power-sucking machines that produce multiple hashes per second.

“Bitcoin could potentially switch to such a consensus algorithm, which would significantly improve sustainability. The only downside is that there are many different versions of proof-of-stake, and none of these have fully proven themselves yet. Nevertheless, the work on these algorithms offers good hope for the future, said de Vries.

-

Silver

- Level 34 Illuminated

- Posts: 5247

Re: Who knows about Bitcoin?

Naysayers abound.

https://www.bloomberg.com/news/articles ... s-jal10hxd

Bitcoin ‘Ought to Be Outlawed,’ Nobel Prize Winner Stiglitz Says

By Kevin Costelloe

November 29, 2017, 6:27 AM CST

Bitcoin 'Ought to Be Outlawed,' Says Joseph Stiglitz

Play Video

Bob Diamond Says Bitcoin Feels Frothy

Stiglitz discusses Bitcoin on Bloomberg Television.

Nobel Prize-winning economist Joseph Stiglitz said “bitcoin is successful only because of its potential for circumvention, lack of oversight.”

https://www.bloomberg.com/news/articles ... s-jal10hxd

Bitcoin ‘Ought to Be Outlawed,’ Nobel Prize Winner Stiglitz Says

By Kevin Costelloe

November 29, 2017, 6:27 AM CST

Bitcoin 'Ought to Be Outlawed,' Says Joseph Stiglitz

Play Video

Bob Diamond Says Bitcoin Feels Frothy

Stiglitz discusses Bitcoin on Bloomberg Television.

Nobel Prize-winning economist Joseph Stiglitz said “bitcoin is successful only because of its potential for circumvention, lack of oversight.”

-

Silver

- Level 34 Illuminated

- Posts: 5247

Re: Who knows about Bitcoin?

https://btcmanager.com/blockchain-bill- ... -approval/

US Department of Defense Submits Blockchain Proposal for Approval

November 29, 2017 11:05 by Joseph Young

The US Department of Defense has submitted the National Defense Authorization Act to President Donald Trump to be approved and signed into law.

Identifying National Security Potential of Blockchain Technology

Section 1646 entitled “Briefing on the Cybersecurity Applications of Blockchain Technology” explicitly described the use case of blockchain technology in national defense and the applicability of an immutable ledger for the protection of sensitive information.

The approval of the bill will lead to extensive research and development on various areas and applications of blockchain technology. The law stated that the US government would be required to provide:

A description of potential offensive and defensive cyber applications of blockchain technology and other distributed database technologies;

An assessment of efforts by foreign powers, extremist organizations, and criminal networks to utilize such technologies;

An assessment of the use or planned use of such technologies by the Federal Government and critical infrastructure networks; and

An assessment of the vulnerabilities of critical infrastructure networks to cyber attacks.

Bill to Mark Further Research

In the upcoming months and throughout 2018, the authorities and researchers within the US Department of Defense will demonstrate practical use cases of blockchain technology outside of the realm of finance.

In an extensive blog post, Navy Lt. Commander Jon McCarter revealed that the US Navy is exploring the usage of blockchain technology in Naval Additive Manufacturing, specifically to share information throughout the manufacturing process of naval equipment on a secure and censorship-resistant ledger.

Mainly, the US Navy will focus its research on using blockchain technology as a secure messenger that is cryptographically secured with timestamps, to ensure that the designs, prototypes, testing results, and production plans are not released to any party or organization apart from those that are directly collaborating with the US Navy.

Navy Lt. Commander McCarter describes the military advantages of securing shared data on the blockchain:

“When looking for a testbed for this technology, it quickly became clear that Naval Additive Manufacturing was a perfect match. The ability to secure and securely share data throughout the manufacturing process (from design, prototyping, testing, production, and ultimately disposal) is critical to Additive Manufacturing and will form the foundation for future advanced manufacturing initiatives. These efforts are pushing the production of critical pieces of gear and equipment closer and closer to deployed forces.”

Interest Follows Resource Stream

As the government allocates more capital and resources into the development of blockchain technology, regional authorities will naturally provide a friendlier ecosystem and regulatory frameworks for firms in the private sector, which are attempting to commercialize the technology at a larger scale.

BBVA, Intel, Microsoft, JPMorgan and Goldman Sachs are already working on the development of blockchain technology. Thus it comes as no surprise that the government’s increasing interest in the applicability of the blockchain will continue to stimulate the rapid growth rate of the industry in the US.

In the long-term, the government may collaborate with blockchain startups operating infrastructures on top of secure and immutable public networks like Bitcoin and Ethereum, rather than relying on permissioned ledgers that are prone to security breaches and hacking attacks.

US Department of Defense Submits Blockchain Proposal for Approval

November 29, 2017 11:05 by Joseph Young

The US Department of Defense has submitted the National Defense Authorization Act to President Donald Trump to be approved and signed into law.

Identifying National Security Potential of Blockchain Technology

Section 1646 entitled “Briefing on the Cybersecurity Applications of Blockchain Technology” explicitly described the use case of blockchain technology in national defense and the applicability of an immutable ledger for the protection of sensitive information.

The approval of the bill will lead to extensive research and development on various areas and applications of blockchain technology. The law stated that the US government would be required to provide:

A description of potential offensive and defensive cyber applications of blockchain technology and other distributed database technologies;

An assessment of efforts by foreign powers, extremist organizations, and criminal networks to utilize such technologies;

An assessment of the use or planned use of such technologies by the Federal Government and critical infrastructure networks; and

An assessment of the vulnerabilities of critical infrastructure networks to cyber attacks.

Bill to Mark Further Research

In the upcoming months and throughout 2018, the authorities and researchers within the US Department of Defense will demonstrate practical use cases of blockchain technology outside of the realm of finance.

In an extensive blog post, Navy Lt. Commander Jon McCarter revealed that the US Navy is exploring the usage of blockchain technology in Naval Additive Manufacturing, specifically to share information throughout the manufacturing process of naval equipment on a secure and censorship-resistant ledger.

Mainly, the US Navy will focus its research on using blockchain technology as a secure messenger that is cryptographically secured with timestamps, to ensure that the designs, prototypes, testing results, and production plans are not released to any party or organization apart from those that are directly collaborating with the US Navy.

Navy Lt. Commander McCarter describes the military advantages of securing shared data on the blockchain:

“When looking for a testbed for this technology, it quickly became clear that Naval Additive Manufacturing was a perfect match. The ability to secure and securely share data throughout the manufacturing process (from design, prototyping, testing, production, and ultimately disposal) is critical to Additive Manufacturing and will form the foundation for future advanced manufacturing initiatives. These efforts are pushing the production of critical pieces of gear and equipment closer and closer to deployed forces.”

Interest Follows Resource Stream

As the government allocates more capital and resources into the development of blockchain technology, regional authorities will naturally provide a friendlier ecosystem and regulatory frameworks for firms in the private sector, which are attempting to commercialize the technology at a larger scale.

BBVA, Intel, Microsoft, JPMorgan and Goldman Sachs are already working on the development of blockchain technology. Thus it comes as no surprise that the government’s increasing interest in the applicability of the blockchain will continue to stimulate the rapid growth rate of the industry in the US.

In the long-term, the government may collaborate with blockchain startups operating infrastructures on top of secure and immutable public networks like Bitcoin and Ethereum, rather than relying on permissioned ledgers that are prone to security breaches and hacking attacks.

-

Silver

- Level 34 Illuminated

- Posts: 5247

Re: Who knows about Bitcoin?

http://www.zerohedge.com/news/2017-11-2 ... ng-bitcoin

Did Janet Yellen Just Recommend Buying Bitcoin

by Tyler Durden

Nov 29, 2017 12:58 PM

Janet Yellen's last semi-annual testimony before Congress as Fed Chair has just concluded, and as usual it was filled long-winded platitudes, which were enough to make the blood of anyone actually listening to her slow-motion drawl, come to an instant boil.

For one, Yellen hypocrisy hit bitcoinian levels when she had the temerity to say that she is “very disturbed” about the trend toward rising inequality, noting that the central bank only has a “blunt tool” that can’t be used to target certain groups. She's right: the "blunt tool", also known as a money printer, is can - and has - been repeatedly used to target a certain group: the ultra wealthy, i.e., the 0.1%, those who as Credit Suisse showed two weeks ago, have never been wealthier.

And just to make sure all your blood has boiled over, Yellen added that the Fed is very focused on “very disturbing long-term trends” in inequality adding that "our own focus"” is on taking those trends and studying them... and making them bigger than ever she should have also added.

Demonstrating her extensive skills of pointing out the obvious, Yellen also said that “we’re suffering from slow productivity growth,” and there should be a focus on how that can be improved. It appears that the Fed is unaware that most employees spend several hours a day on Facebook, LinkedIn and SnapChat; it also appears that the Fed is unaware that most employers are aware of this, and is why there has been so little wage growth to "reward" this collapse in productivity.

Yellen had some advice: Congress and Trump administration “have a much wider set of tools” to address these urgent issues, which are “squarely in Congress’s court.” That would have been a more useful handoff about 9 years ago, which Bernanke could have made the same point instead of unleashing what has become a $15 trillion liquidity injecting between the world's central banks.

If that wasn't enough, Yellen's hypocrisy then veered off into a tangent when she said that the central bank is concerned with "growth getting out of hand" and is committed to continuing to raise rates in a gradual manner. "We don't want to cause a boom-bust condition in the economy," Yellen told Congress.

While Yellen did not specifically commit to a December rate hike, her comments indicated that her views have not changed with her desire for the central bank to continue normalizing policy after years of historically high accommodation.

"We are not seeing undue inflationary pressure in the labor market, so our policy remains accommodative," Yellen said. "But we do think it's important to gradually move our policy rate toward what I'll call a neutral level, which would be consistent with sustainably strong labor market conditions," she said.

Yellen said the Fed does not want to stifle growth but feels strongly about keeping consistent with a labor market that is nearing full employment. "We want to do this gradually, because if we allow the economy to overheat, we could be faced with a situation where we might have to ... raise rates and throw the economy into recession," she said. "We don't want to cause a boom-bust condition in the economy."

But the punchline was when Yellen said she is also, drumroll, "concerned over the surging level of public debt."

Yellen's timely "concern" finally emerged as Congress is debating the passage of a tax cut bill which will cost around $1.5 trillion in new debt, and comes at a time when the CBO is already projecting a deficit of more than $1 trillion in the years ahead and with the total debt level at $20.6 trillion and rising. Yellen was asked about a proposal that would trigger tax hikes if economic goals are not met. Yellen did not specifically comment on the trigger plan but said Congress is right to be thinking about the future of the national debt.

"I would simply say that I am very worried about the sustainability of the U.S. debt trajectory," Yellen said. "Our current debt-to-GDP ratio of about 75 percent is not frightening but it's also not low."

"It's the type of thing that should keep people awake at night," she added.

So let us get this straight: after nearly a decade of keeping rates at record low levels and directly monetizing all the deficit for Obama's administration, Yellen is suddenly worried about the $20+ trillion in debt it has left the country with?

Apparently so. As even CNBC concedes, "the Fed has critics of its own, though, who say that the central bank helped balloon the debt through low interest rates kept in place since the financial crisis. The Fed kept its benchmark rate anchored near-zero for seven years, from December 2008 through December 2015. During that time, the national debt grew 77 percent."

Incidentally, Yellen is referring to the following CBO forecast, which sees US federal debt rising to levels last seen around the time of World War II:

Which also begs the question: fine, people are finally being "kept up at night" over something we, and others, have long said is a catastrophe for the US (except of course for those occasional econo-idiots known as the Magic Money Tree fanatics, or MMTers). So what is the alternative? If Yellen is right and the endgame is a collapse in the US economy, it means the days of the dollar as a reserve currency are numbered, incidentally something else not just we, but Deutsche Bank has also said previously. Recall what DB's Jim Reid warned in September:

Global central banks have facilitated these elevated asset prices. A long series of global financial problems have now been passed through all parts of the financial system with most of these problems stacked up and now resting with central banks and Governments. The buildup of debt that this has created has forced central banks to keep yields at ultra-low levels, thus raising the prices of a variety of other global assets.

We think the final break with precious metal currency systems from the early 1970s (after centuries of adhering to such regimes) and to a fiat currency world has encouraged budget deficits, rising debts, huge credit creation, ultra loose monetary policy, global build-up of imbalances, financial deregulation and more unstable markets.

And if that is indeed the case, it would suggest that Yellen is indirectly - and directly - recommending that her audience buy bitcoin, because it is not just the US which finds itself in a fiscal and monetary dead end, it is every other fiat economy (something DB's Jim Reid warned about two months ago). As a result, the only viable monetary system in a world in which even central banks now warn the debt is "too damn high", is one in which central banks themselves are disintermediated, i .e. a world in which cryptocurrencies rule.

Which, in retrospect, is not a surprise: back in July we got an amusing, if very vivid harbinger, of what may be coming.

Did Janet Yellen Just Recommend Buying Bitcoin

by Tyler Durden

Nov 29, 2017 12:58 PM

Janet Yellen's last semi-annual testimony before Congress as Fed Chair has just concluded, and as usual it was filled long-winded platitudes, which were enough to make the blood of anyone actually listening to her slow-motion drawl, come to an instant boil.

For one, Yellen hypocrisy hit bitcoinian levels when she had the temerity to say that she is “very disturbed” about the trend toward rising inequality, noting that the central bank only has a “blunt tool” that can’t be used to target certain groups. She's right: the "blunt tool", also known as a money printer, is can - and has - been repeatedly used to target a certain group: the ultra wealthy, i.e., the 0.1%, those who as Credit Suisse showed two weeks ago, have never been wealthier.

And just to make sure all your blood has boiled over, Yellen added that the Fed is very focused on “very disturbing long-term trends” in inequality adding that "our own focus"” is on taking those trends and studying them... and making them bigger than ever she should have also added.

Demonstrating her extensive skills of pointing out the obvious, Yellen also said that “we’re suffering from slow productivity growth,” and there should be a focus on how that can be improved. It appears that the Fed is unaware that most employees spend several hours a day on Facebook, LinkedIn and SnapChat; it also appears that the Fed is unaware that most employers are aware of this, and is why there has been so little wage growth to "reward" this collapse in productivity.

Yellen had some advice: Congress and Trump administration “have a much wider set of tools” to address these urgent issues, which are “squarely in Congress’s court.” That would have been a more useful handoff about 9 years ago, which Bernanke could have made the same point instead of unleashing what has become a $15 trillion liquidity injecting between the world's central banks.

If that wasn't enough, Yellen's hypocrisy then veered off into a tangent when she said that the central bank is concerned with "growth getting out of hand" and is committed to continuing to raise rates in a gradual manner. "We don't want to cause a boom-bust condition in the economy," Yellen told Congress.

While Yellen did not specifically commit to a December rate hike, her comments indicated that her views have not changed with her desire for the central bank to continue normalizing policy after years of historically high accommodation.

"We are not seeing undue inflationary pressure in the labor market, so our policy remains accommodative," Yellen said. "But we do think it's important to gradually move our policy rate toward what I'll call a neutral level, which would be consistent with sustainably strong labor market conditions," she said.

Yellen said the Fed does not want to stifle growth but feels strongly about keeping consistent with a labor market that is nearing full employment. "We want to do this gradually, because if we allow the economy to overheat, we could be faced with a situation where we might have to ... raise rates and throw the economy into recession," she said. "We don't want to cause a boom-bust condition in the economy."

But the punchline was when Yellen said she is also, drumroll, "concerned over the surging level of public debt."

Yellen's timely "concern" finally emerged as Congress is debating the passage of a tax cut bill which will cost around $1.5 trillion in new debt, and comes at a time when the CBO is already projecting a deficit of more than $1 trillion in the years ahead and with the total debt level at $20.6 trillion and rising. Yellen was asked about a proposal that would trigger tax hikes if economic goals are not met. Yellen did not specifically comment on the trigger plan but said Congress is right to be thinking about the future of the national debt.

"I would simply say that I am very worried about the sustainability of the U.S. debt trajectory," Yellen said. "Our current debt-to-GDP ratio of about 75 percent is not frightening but it's also not low."

"It's the type of thing that should keep people awake at night," she added.

So let us get this straight: after nearly a decade of keeping rates at record low levels and directly monetizing all the deficit for Obama's administration, Yellen is suddenly worried about the $20+ trillion in debt it has left the country with?

Apparently so. As even CNBC concedes, "the Fed has critics of its own, though, who say that the central bank helped balloon the debt through low interest rates kept in place since the financial crisis. The Fed kept its benchmark rate anchored near-zero for seven years, from December 2008 through December 2015. During that time, the national debt grew 77 percent."

Incidentally, Yellen is referring to the following CBO forecast, which sees US federal debt rising to levels last seen around the time of World War II:

Which also begs the question: fine, people are finally being "kept up at night" over something we, and others, have long said is a catastrophe for the US (except of course for those occasional econo-idiots known as the Magic Money Tree fanatics, or MMTers). So what is the alternative? If Yellen is right and the endgame is a collapse in the US economy, it means the days of the dollar as a reserve currency are numbered, incidentally something else not just we, but Deutsche Bank has also said previously. Recall what DB's Jim Reid warned in September:

Global central banks have facilitated these elevated asset prices. A long series of global financial problems have now been passed through all parts of the financial system with most of these problems stacked up and now resting with central banks and Governments. The buildup of debt that this has created has forced central banks to keep yields at ultra-low levels, thus raising the prices of a variety of other global assets.

We think the final break with precious metal currency systems from the early 1970s (after centuries of adhering to such regimes) and to a fiat currency world has encouraged budget deficits, rising debts, huge credit creation, ultra loose monetary policy, global build-up of imbalances, financial deregulation and more unstable markets.

And if that is indeed the case, it would suggest that Yellen is indirectly - and directly - recommending that her audience buy bitcoin, because it is not just the US which finds itself in a fiscal and monetary dead end, it is every other fiat economy (something DB's Jim Reid warned about two months ago). As a result, the only viable monetary system in a world in which even central banks now warn the debt is "too damn high", is one in which central banks themselves are disintermediated, i .e. a world in which cryptocurrencies rule.

Which, in retrospect, is not a surprise: back in July we got an amusing, if very vivid harbinger, of what may be coming.

-

Silver

- Level 34 Illuminated

- Posts: 5247

Re: Who knows about Bitcoin?

https://www.coindesk.com/coindesk-state ... n-q3-2017/

CoinDesk Releases Q3 Bitcoin and Blockchain Industry Report

Nov 28, 2017 at 11:00

Nolan Bauerle is a former researcher and writer for the Canadian Senate Banking Committee, for which he drafted a 2015 report on cryptocurrencies and blockchain technology. He currently heads CoinDesk research division.

CoinDesk is today announcing the release of its latest deep-dive report on the state of blockchain technology and cryptocurrencies.

The most recent of a series of quarterly updates that began in 2014, our State of Blockchain Q3 2017 report includes over 100 graphs that tell the story of another historic quarter for the industry.

Divided into sections designed to help readers navigate the comprehensive industry data, the report also includes a unique sentiment survey with over 50 questions that provide insight on developing market trends.

Here are the highlights:

1. Market overcomes regulatory challenges

Bitcoin hit all-time highs in Q3, and macroeconomics were at the heart of the push.

Our State of Blockchain Q3 sentiment survey found that readers believe bitcoin's most important attribute is now its ability to act as a hedge against monetary uncertainty. Notably, this may be as that conviction was challenged uniquely this quarter, with multiple executive authorities announcing regulatory action.

Q3, for example, saw Chinese regulators demand that exchanges stop trades. BTCC, one of the largest Chinese exchanges, complied with the order and stopped trades on the final day of Q3.

Still, the growth of global trade volume couldn't be stopped. As the charts show, the actions by China's regulators barely registered on a chart that was otherwise up.

In this way, demand for bitcoin continued to grow in the quarter. The price crossed the $5,000 mark for the first time, and was much higher in some countries, again for macroeconomic reasons.

In nations where central bank policy was particularly restrictive, bitcoin behaved as a "crisis currency." Zimbabwe and Venezuela saw record high exchange rates, for example. This was on the heels of BTC trading at a premium in India after its own demonetization effort in Q4 2016.

2. Bitcoin tested by forks

On the technical front, bitcoin experienced numerous tests, with both a soft and hard fork (two varying kinds of software upgrades) in Q3.

The soft fork allowed for the adoption of code called Segregated Witness, which in turn opened bitcoin to several new cryptographic innovations. This has also resulted in the first ever block on the bitcoin blockchain that exceeded 1 MB in size.

Yet, the change was not without its critics, and the fork resulted in the creation of bitcoin cash, an alternative blockchain spun off from bitcoin's code and which boasted 8MB blocks.

Still, it remains to be seen how successfully the new blockchain can compete with bitcoin in the long run.

3. Record ICO and VC raises

Of course, it's possible the Q3 story was a lot simpler than macroeconomics, crisis currencies or technical and philosophical debates. Maybe it was simply that people made money.

ICOs and VC investment hit new highs this quarter. ICOs raised $1.24 billion, led by Filecoin, and Tezos, while Coinbase raised $100 million in VC funding, which put its valuation at $1.6 billion. The round, announced in August, meant that Coinbase became the industry's first unicorn.

With ICOs, token diversification throughout 2017 sparked the growth of a sophisticated buy side. Pioneering analysts are now working hard to understand valuations, and to write the book on new key price indicators.

Whether its a technical analysis, use case, team, white paper, code reviews, or other factors, this group has made a huge splash this quarter, with the launch of over 100 new crypto hedge funds.

4. Key metrics up across public blockchains

Elsewhere, there was a steady improvement in other metric areas.

Transactions, block sizes, hash rates, new addresses and trades also saw all-time records, with ethereum hitting a new record high for transactions on a blockchain over a 24-hour period.